Crypto wallets are an indispensable tool for all crypto traders. They are so important to the trader that losing them could amount to one losing his whole assets. Crypto wallets enable crypto traders to store their crypto assets on a blockchain. Without a wallet address, one cannot send, receive or own cryptocurrency. The fact that investors often converted a large portion of their wealth into crypto has made it crucial that we consider the safest forms of wallet to utilize in sending, receiving, and storing crypto. Businesses who are in need of QR codes should consider using the TRUiC QR code generator. This allows a business to generate QR codes and then use these codes for any number of applications.

What Are Cryptocurrency Wallets

Cryptocurrency wallets are storage applications for holding all forms of cryptocurrency. Crypto wallets make it possible for crypto traders to send and receive crypto. Each wallet provides a unique ID for sending and receiving cryptocurrency. Wallets usually come in form of digital apps used for storing secret codes used in signing and approving crypto transactions carried out on a blockchain.

Each crypto wallet is usually protected using a private known only to the owners. The private key enables the users to access their wallets from any other device at each point they desire it.

When was the first crypto wallet Created?

The first crypto wallet was created in 2009 by the anonymous founder of Bitcoin known as Satoshi Nakamoto. He introduced the first and best Bitcoin wallet for storing Bitcoin. Since then, other Blockchain developers emulated him to create similar wallets for holding altcoins.

Forms of wallets

All cryptocurrency wallets usually come in two forms: Hot and Cold wallets.

Hot wallets are those wallets designed to function using the internet. They are usually connected by encryptions to the central storage system. Users of this type of wallet can only access it when they login into the device using their private keys and backup codes online. Hot wallets have the major disadvantage of being exposed to attacks from hackers and other malware devices.

Cold wallets refer to those wallets that function without any internet connection. This form of wallet has been considered the safest form of wallet as they are not open to attack from hackers. They are hardware devices with a storage capacity to hold crypto. A cold wallet offers the user greater privacy and security of assets when compared to a cold wallet. This is based on the fact that it is not linked to the internet and cannot be easily assessed.

Types of Cryptocurrency Wallets

There are six basic types of crypto wallets available to users today. Each type of wallet has its unique features. However, the level of security offered by these wallets varies according to the type of wallet one is using. They include Exchange wallets, desktops, hardware, online (web), paper, and mobile wallets.

Exchange Wallet (HOT)

An exchange wallet is a type of wallet that is provided by various crypto exchanges for trading different cryptocurrencies on their platforms. This type of wallet is usually built on a Blockchain network and made available to users for trading, hodling, sending, and receiving different cryptocurrencies on the exchange. The exchange wallet is usually controlled by the owners of the exchange and does not give users total control over their transactions. Often the users are charged some commissions when they perform any transactions using the exchange wallets. The exchange wallet does not provide any private key and codes for retrieving one’s wallet using any device. It only offers login details and passwords which the user is required to choose during his initial registration.

Examples of exchange wallets are Coinbase, Binance, eToro, Kucoin Capita.com, Luno, etc.

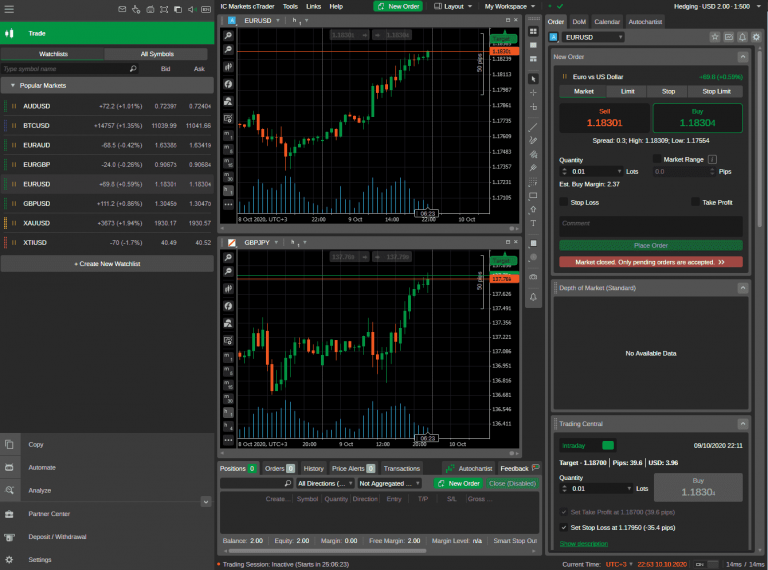

Desktop Wallet (HOT)

Desktop wallet as the name implies; requires the user to download the storage applications on their desktop or laptop computer. This is quite unlike the exchange wallet limited to the exchange platform only. The Desktop wallet gives users greater control over their crypto assets stored in the wallet. The Desktop wallet provides other features such as private keys and nodes. The fact that desktop wallets require an internet connection to access them makes them prone to attacks and hacking.

Examples of desktop wallets are Armory, Exodus, Multibit, and Bitcoin Core.

Hardware Wallet (COLD)

A hardware wallet is a very reliable crypto storage wallet that allows traders to obtain crypto from any of their preferred exchanges or through other means, and store them offline. This helps to provide maximum security for the cryptos stored. The hardware wallet stores the user’s private keys with which he can access his assets offline. A hardware wallet often comes in different forms and shapes and with enough storage capacity.

Examples of hardware wallets are Trezor Model One, Ledger Nano S, SafePal S1, Steel Bitcoin Wallet for Hardware Wallet Backup, Trezor Model T-Next Generation, D’CENT Biometric Wallet, SecuX V20, and SecuX W20.

Online Wallet (HOT)

The online wallet also called a Web wallet refers to those crypto wallets that you can only access via your web browser. This type of wallet is characteristically a hot wallet and cannot be accessed without the internet. This singular fact increases the risk associated with using this type of wallet. Often traders are attracted to this online wallet because of the great speed it uses to execute all transactions initiated. There is usually no lag between the locations of the app and server when using the web wallet. Examples of online wallets are GreenAddress, Metamask, Nifty wallet, and Oxigen wallet.

The greatest disadvantage of using the online wallet is that users are susceptible to phishing scams, malware, insider hacking, DDOS attacks, and outdated security measures.

Paper Wallet (HOT)

Paper wallets are the most ancient form of hot wallet for crypto storage. Usually, the paper wallet has a printout of all your crypto asset details. Paper wallets also contain your private keys, wallet addresses, wallet QR codes, and backup seed. This type of wallet is more highly secured than other forms of cryptocurrency wallet.

Often users tend to criticize the paper wallet based on the fact that it requires so much to move crypto stored in them. Examples of paper wallets are BitAddress.org and Bitcoin Armory.

Mobile Wallets (HOT)

A mobile wallet is an easy-to-use wallet providing access to one’s crypto assets at all points. They are usually app-based wallets designed for smartphone devices such as Android, iOS, or Windows. Mobile wallets are fully internet-based wallets. Hence, they have greater risk exposures. Often using a mobile wallet exposes one phone to malware, keyloggers, and viruses.

Examples of mobile wallets are Jaxx, electrum, BreadWallet, Mycelium, and CoPay.

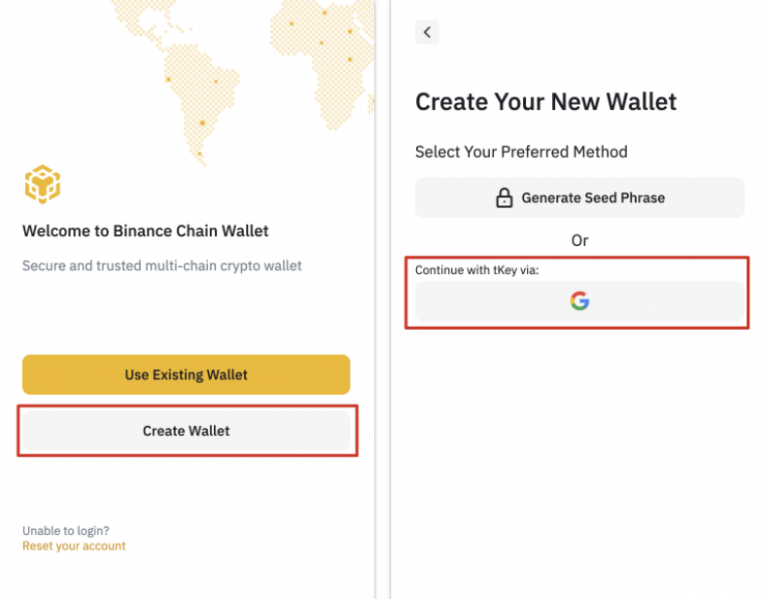

How to Unlock a crypto wallet

Virtually all the various types of wallets we have examined have a secret code used in unlocking them. This is known as private keys and is often stored within the user’s wallet, or online. A few hot wallets especially those connected to exchange do not use private keys. These categories require login details such as email and password to access them.

To unlock a wallet, the user is expected to enter his private key into the app or new device to import his existing wallet address. Private keys coded words restricted to a particular wallet granting access to it once inserted.

Next, to unlock the exchange-based wallets, the user will have to login into the application and enter his email and password. Often the exchange sends a confirmatory email to the user first before granting access to the wallet. This is to ensure that the user’s account has not been hacked.

Which type of wallet is the most secured for investors?

Each wallet as we have seen has its uniqueness and the purpose they serve.

However, cold wallets are the best choice for investors to use in safeguarding their assets. This is because this form of wallet remains the most secured. The best-known cold wallets today are hardware wallets.