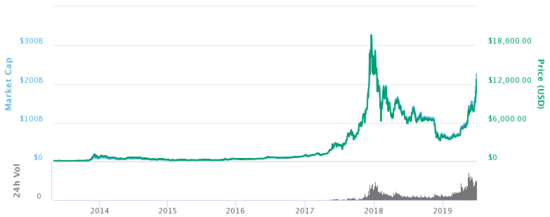

For cryptos, the year 2021 was great. New exchange platforms and more advanced platforms came into existence and also the growth of Bitcoin increased. And keeping in mind that the period characterizing occasions pushed the resources towards a euphoric region, the beginning of 2022 was everything except delighted. The market kept on exchanging sideways, and, surprisingly, the most encouraging crypto players continued to shed gains.

Notwithstanding, the reach-bound market could barely scratch financial backers’ opinions. Driving stages kept on seeing a great deal of activity over the last few weeks or something like that. Also, with new postings becoming the dominant focal point, 2022 is good to go to turn into a watershed year concerning the eagerly awaited crypto reception.

In any case, there is always a better solution for these! Consistently in the crypto timetable requires various techniques to succeed. Along these lines, financial backers wanting to become famous in the crypto space in 2022 should keep six brilliant guidelines in mind to remain protected and in the green. And keeping in mind that exchanging over secure trades and enhancing the portfolio are still guidelines enough, we will cover the 2022 special features until further notice.

DYOR Strictly

Crypto devices, bars, outlines, pointers, whitepapers, and instructive assets are ever-solid. But for all such things, one should always do their research in theyear 2022. Crypto is a strange space with each chance contingent upon the erratic idea of us, the people.

In this manner, each specific goody, head information, and more won’t offer a widely inclusive response for your cash the board stresses, simply a minor advantage. DYOR gives you that edge, giving you contribute energy rigorously.

1. Fundamental Examination

Knowing the coin or token better will be the subject in 2022. As the new players are showing up with time, one must learn about the tokenomics, the market value, and the utilities that will be out the same as the sway picks. Likewise, if you’re not aware of the possibility of fundamental examination yet, strong exchanges ensure that recently checked, secure, and dependable tokens are available for you to investigate. But, for that, you must choose your exchange wisely. Bitcoin Era would be the best option for safely running your trade g process.

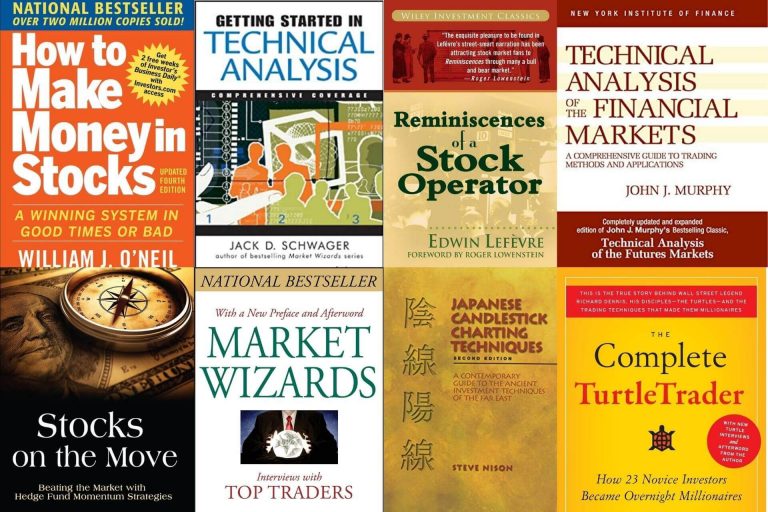

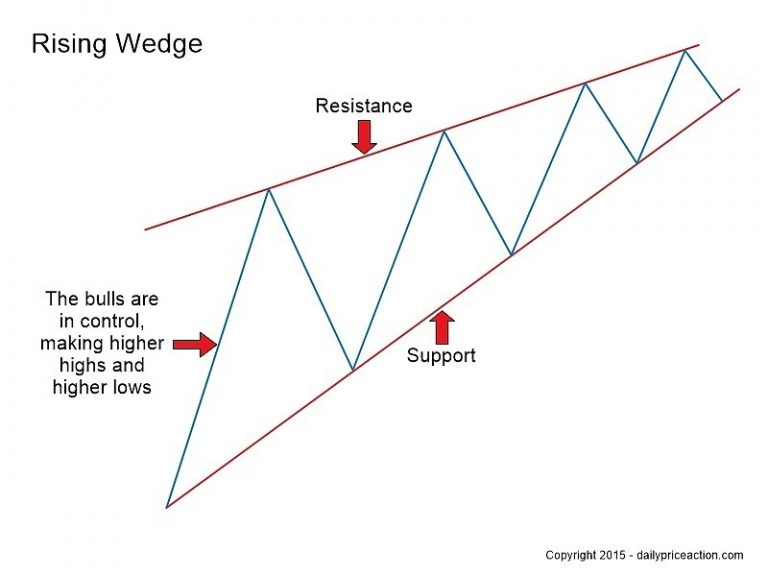

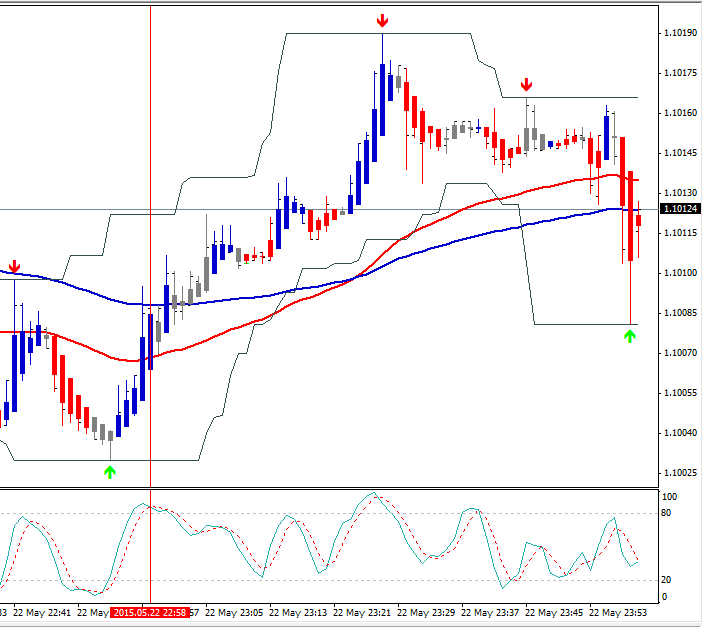

2. Technical examination

You can expect eccentric market advancements in 2022. Also, that is not a conjecture yet rather a savvy instinct. Doing your assessment for a particular examination can help you with anticipating the gigantic market improvements better than others. In addition, as it’s underrated as a contraption, particular authority can appear to be a one-of-a-kind benefit for the monetary supporter in you.

3. Use Cases

There is another thing to the coin or token other than the basics and technicals. Before viable cash the board or regardless, hodling a specific asset in 2022, you should DYOR as for this current reality benefits. Check for any previous records and the benefits you may have in 2022.

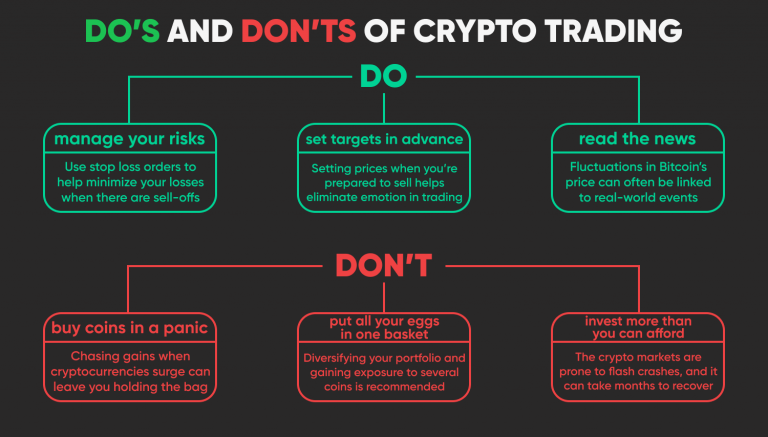

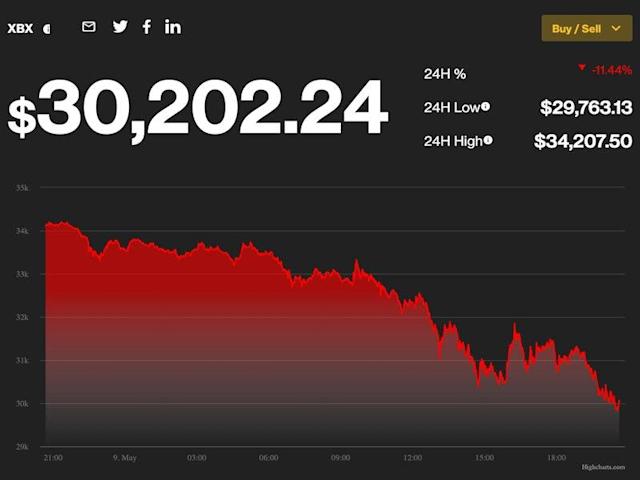

4. Account For Volatility

As per Nils Gregersen, CTO, Payer, the current crypto space is encountering a monstrous siphon. What’s more, this pattern could prompt a ton of instability before very long when individuals begin changing out their property.

Furthermore, with ‘Siphon and Dump’ plans being normal in the crypto space, you could see some cooldown or expanded solidification. However, that is not something to be stressed over. Not assuming that you are a crypto-financial backer.

5. Do Not Ride The Hype

Is it true or not that you are wanting to follow Elon Musk in 2022 just for his secretive crypto tweets? Indeed, as a financial backer hoping to become famous in 2022, that is by and large the thing you ‘Shouldn’t’ do. Do not go with the speculations around cryptos, do your own research and search for the actual facts.

6. Go Old School

Any semblance of Bitcoin(BTC), Ethereum(ETH), Polkadot(DOT), Polygon(MATIC), and Solana(SOL) are more similar to old-school crypto head honchos and also proved to be profitable. These resources have their eyes set on mining adaptability, exchange proficiency, and blockchain interoperability, from there, the sky is the limit, making them solid venture instruments.

As a financial backer, if you don’t know about the new altcoins and their implied use cases, going by the book and considering these attempted and tried crypto players appears to be a superior thought. Also, if you need to find out about every one of these resources exhaustively.

Regardless of all the ups and downs, follow this guide to be the best investor of all time. These are expert-advised tips that will help you grow well in the market.

![AFLPlanning Review – Quick Trades for Active Investors [2022 Updated] AFLPlanning Review – Quick Trades for Active Investors [2022 Updated]](https://henof.com/wp-content/uploads/2022/04/image1-2-768x512.jpg)

![Trade Markets Review | Great Features for Traders To Look At [Updated] Trade Markets Review | Great Features for Traders To Look At [Updated]](https://henof.com/wp-content/uploads/2022/04/image1-1-768x512.jpg)