Trend trading is a popular method among traders aiming to capitalize on the long-term directional movements of economic assets. One such asset that has intrigued investors for centuries is gold.

With its inherent value and status as a safe-haven asset, gold trading attracts novice and experienced traders. This article will explore some effective trend trading strategies for enhancing their gold trading endeavours.

What Is Trend Trading?

Trend trading is a technique that involves recognizing and following the prevailing market trend in a specific financial instrument. Traders attempt to enter the market when a trend is set and ride the price movement until signs of a trend reversal emerge. This strategy allows traders to profit from sustained price movements and minimize the impact of short-term market fluctuations.

The Attraction Of Gold Trading

Gold trading has been an appealing investment option due to its safe-haven nature. Investors often flock to gold during economic uncertainty or geopolitical turmoil, driving its price upward. The relative stability of gold compared to other financial assets makes it an attractive addition to a diversified investment portfolio.

Trend Trading Strategies For Gold

Moving Averages

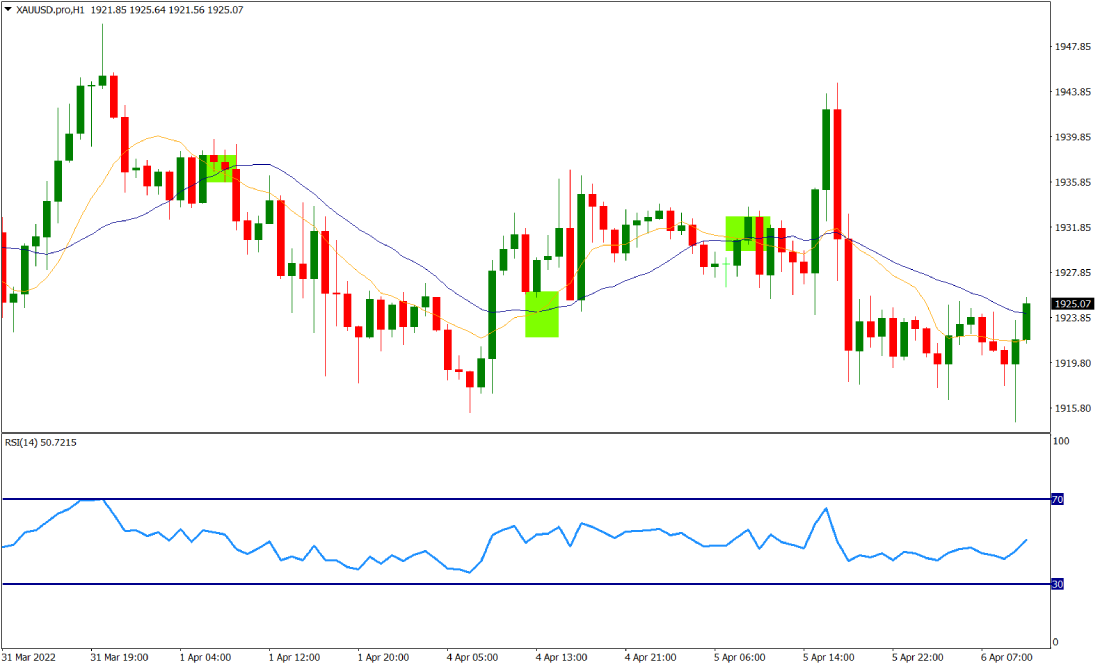

Moving averages are a fundamental tool in trend trading. The 50-day and 200-day moving averages are typical to identify trends. When the short-time moving average exceeds the long-time moving average, it indicates a potential uptrend and vice versa for a downtrend. Traders can use these crossovers as entrance and exit points.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that calculates the speed and change of price directions. An RSI reading above 70 suggests the asset is overbought, while an RSI below 30 indicates oversold conditions. Traders can use the RSI to spot potential trend reversals and make informed trading decisions.

Fibonacci Retracement

Fibonacci retracement levels are flat lines drawn on a price chart to determine possible support and resistance levels. Traders can use these levels to find entry and exit points in a trending market.

Bollinger Bands

Bollinger Bands consist of a moving average and two standard tangent lines. When the market is explosive, the bands widen, and when it’s stable, they narrow. Traders can use Bollinger Bands to gauge market volatility and identify potential trend reversal points.

MACD (Moving Average Convergence Divergence)

MACD is a trend-following momentum indicator that displays the connection between two moving averages. When the MACD bar travels above the signal line, it signifies an uptrend; when it crosses below, it shows a downtrend. Traders can use the MACD to confirm trend signals.

Setting Stop-Loss And Take-Profit Levels

Implementing effective risk management is vital in trend trading. Setting appropriate stop-loss and take-profit levels helps protect capital and secure profits. Traders should determine these levels based on their risk tolerance and the market’s volatility.

Risk Management In Trend Trading

Trend trading inherently carries risks, and traders should prepare to handle them. Risk management involves using position sizing, diversification, and risk-reward ratios to minimize potential losses and maximize gains.

Combining Multiple Strategies

Experienced traders often combine different trend trading strategies to ensure signals and raise the chance of successful trades. Traders can create a robust trading approach by analyzing multiple indicators and patterns.

The Importance Of Demo Trading

Before committing to real funds, traders should practice their trend trading strategies in a risk-free environment. When choosing a gold broker, it is good to choose one that offers demo accounts. Demo trading allows traders to test their system and gain confidence without risking capital.

Developing A Trading Plan

A well-defined trading strategy is crucial for constant success in trend trading. It should contain entrance and exit rules, risk-managing processes, and a clear outline of the trader’s objectives.

Psychological Aspects Of Trend Trading

Trend trading can be emotionally demanding, specifically during times of drawdowns. Managing emotions like fear and greed is crucial to maintaining discipline and following the trading plan.

Diversification In Gold Trading

Diversifying the portfolio beyond gold can help mitigate risks associated with trend trading. By allocating funds to different assets, traders can reduce exposure to gold price fluctuations.

Trend trading in the gold market offers exciting opportunities for investors seeking steady long-term growth. By employing various trend trading strategies and adhering to proper risk management, traders can navigate the complexities of the market successfully. Remember to continuously learn and adapt, as the financial markets are dynamic and ever-changing.

FAQs

Is trend trading suitable for beginners?

Yes, trend trading can be suitable for beginners. It offers a structured approach to trading that focuses on long-term trends, making it less reliant on intricate market analysis.

What is the best time frame for trend trading in gold?

The best time frame for trend trading in gold depends on individual trading preferences and objectives. Some traders prefer daily or weekly charts, while others may opt for shorter time frames like hourly or 4-hour charts.

Can I use all the mentioned trend trading strategies simultaneously?

Yes, traders can simultaneously use multiple trend trading strategies to confirm signals and enhance their trading decisions.

Is gold trading affected by economic events?

Yes, economic events can influence gold trading, especially those that impact market sentiment and the overall global economic outlook.

How much capital do I need to start trend trading in gold?

The required capital for trend trading in gold varies based on the trader’s risk tolerance and chosen trading strategy. It’s essential to start with an amount you can afford to lose and gradually increase capital as you gain experience.